Using Credit Support portal

The NEM See Relevant Rules or ProceduresCredit Support See Relevant Rules or Procedures page consists of the following details:

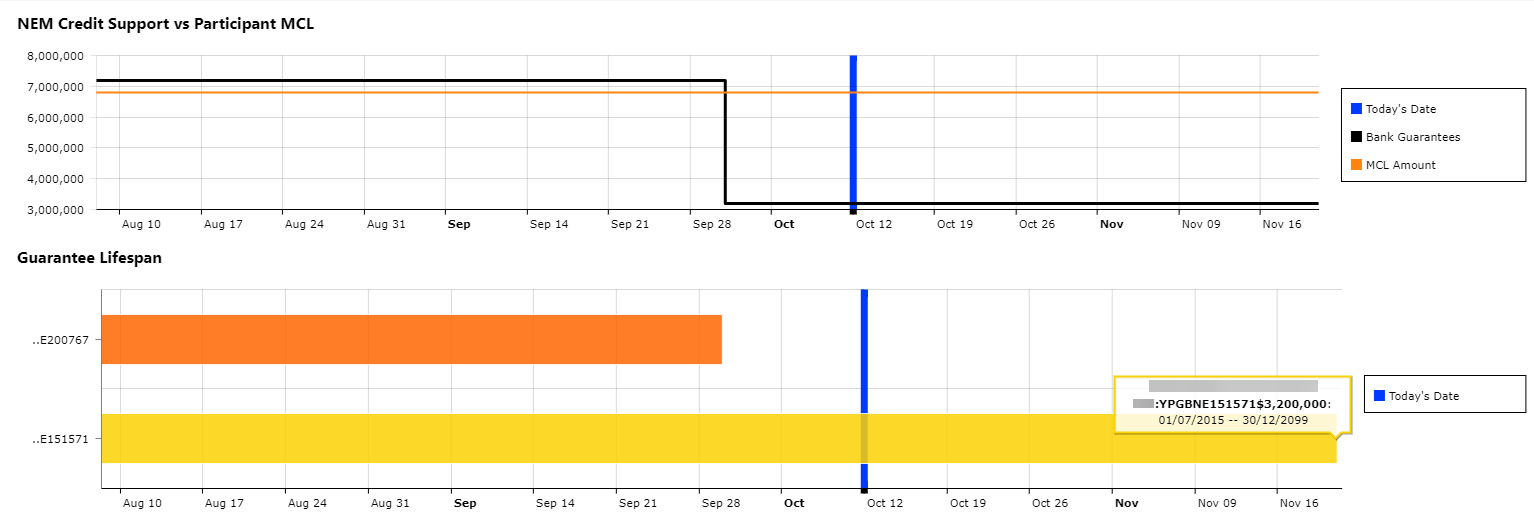

- A graph that provide a view of a Company’s Credit Support Status against the Company’s Maximum Credit Limit See Relevant Rules or Procedures (MCL Maximum Credit Limit).

- A graph depicting the lifespan of all available Bank Guarantees.

The image above consists of two aligned graphs that should be read/analysed concurrently.

- Participant Guarantee Totals Vs Participant MCL – provides the total of all active credit support against the Company’s Maximum Credit Limit (MCL). This graph displays data for a period that spans 65 days in the past to 40 days in the future from the current date.

- Guarantee Lifespan Chart – displays individual Credit Support/Bank Guarantees in a Gantt chart. This graph displays data for a period that spans 65 days in the past to 40 days in the future from the current date.

Other components include:

- Graph Legend - uses colours to guide the user while analysing the graphs.

The colours are as follows:

- Blue indicates today's date

- Orange indicates the Maxium Credit Limit amount.

- Black indicates the Credit Support amount.

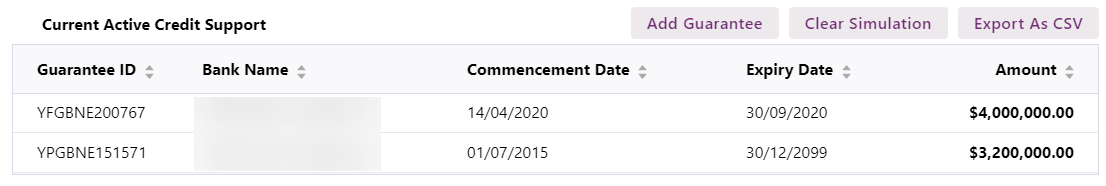

The NEM Credit Support web page also consists of the following data sections:

- Current Active Credit Support - displays the details of each current active Bank Guarantees of a Company. Also, allows participants to create mock scenarios by adding bank guarantees.

- Maximum Credit Limit (MCL) - displays the currently active MCL details and any upcoming MCL reviews yet to be effective.

Other components include:

- MCL Schedules – displays the MCL schedule in the Settlements See Relevant Rules or Procedures page of the AEMO Australian Energy Market Operator website.

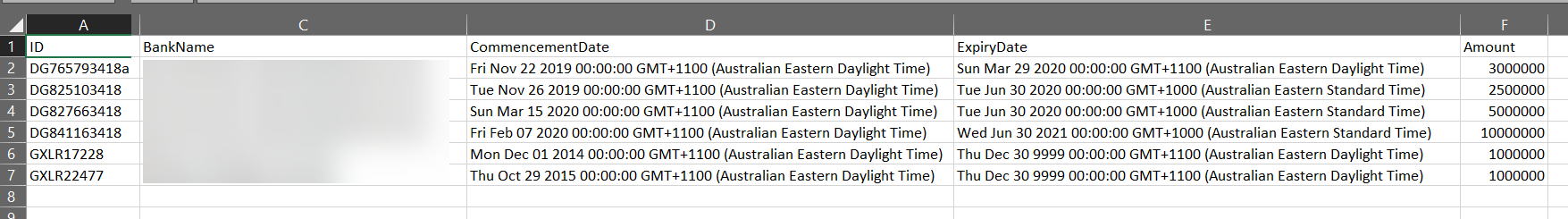

- Export as CSV – exports the data in the given section to a .csv Comma Separated Values. A file format for data using commas as delimiters. file.

For example, using the Export as CSV for the Current The participant can receive files compliant to the current aseXML version. active credit support table, downloads an Excel sheet with the values as shown below:

Current active credit support details

The current active credit support allows the participants to view all existing active bank guarantees within the with the following details:

- Guarantee ID: a unique identifier for each bank guarantee added.

- Bank ID: a unique identifier for the bank

- Bank Name: the name of the bank

- Commencement Date: the start date of the bank guarantee

- Expiry A reallocation request expires if it is not authorised prior to the submission cut-off date applicable to the start date of the reallocation request. Date: is the least of expiry date or the return date (if the participant cancels the guarantee prematurely).

- Amount: the bank guarantee amount. This value is highlighted in yellow, if the guarantee expires within 30 days.

A credit support status is considered active until the expiry date is complete or AEMO has returned the bank guarantee.

You can also use this section to build mock scenarios and see how the graphs change based on the newly added bank guarantee. For more information on building scenarios, see Building scenarios on page 1.

You can sort the rows in this section by clicking the tiny up and down arrows beside the column name.

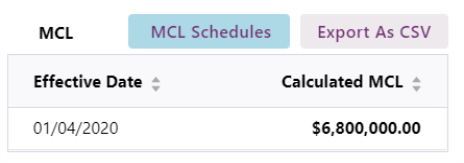

Maximum Credit Limit (MCL) details

The Maximum Credit Limit (MCL) section allows the participants to view the following details:

- Effective Date The trading day specified in a Bid/Offer, and any subsequent trading days until superseded by a later valid Bid/Offer.: a date at which the Calculated MCL is effective.

- Calculated MCL: The Maximum Credit Limit (MCL) is the latest effective maximum credit limit determined by AEMO for the Market Participant See Relevant Rules or Procedures. It is equal to the value shown on the most recent MCL review letter issued by AEMO.

The MCL table.displays the MCL requirement for every single day during the active period.

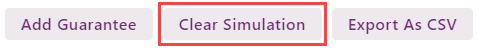

Building scenarios

The scenario builder option allows participant users to add, delete and edit mock-up Bank Guarantees. The associated graphs and numerical data are updated in real time. The aim of the page is to assist participants in planning and managing Bank Guarantees at the present time and in the future.

The mock-up Guarantees are not saved into the Market Management System and therefore will not be counted as current/active Bank Guarantees in the Status Page. Information will be discarded when the page is closed.

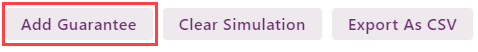

Adding bank guarantees

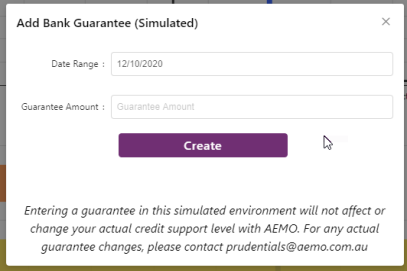

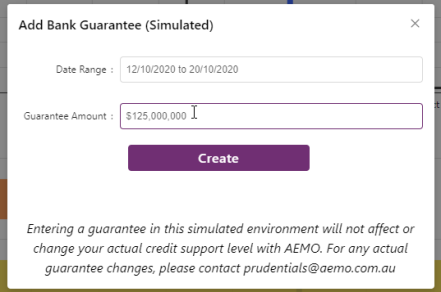

To add a bank guarantee:

- In the Current Active Credit Support section, click Add Guarantee.

The Add Bank Gurantee (Simulated) window opens.

- Select a date range by spanning over the date Commencement and Expiry dates.

- Next, add a Guarantee Amount.

- Click Create.

This adds a new entry in the Guarantee Lifespan graph with an Guarantee ID and updates both the graphs based on the dates and the guarantee amount.

The difference between an actual bank guarantee and a mock value is the absence of the bank name field for the mock bank guarantee, instead the Bank name field says Entry for simulation only.

The Current Active Credit Support section updates with the details, if the mock bank guarantee is within the active period.

Editing bank guarantees

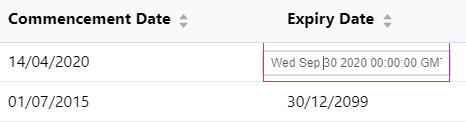

To edit a bank guarantee:

- Select a Bank Guarantee from the Current Active Credit Support table.

- Click the Expiry Date in the table to start editing.

- Edit the date.

- Click anywhere on the webpage to commit the changes in the screen.

The graphs are updated to reflect the new expiry dates.

Clearing bank guarantees

To clear a bank guarantee:

This removes all the mock entries you have added from the Guarantee Lifespan graph.